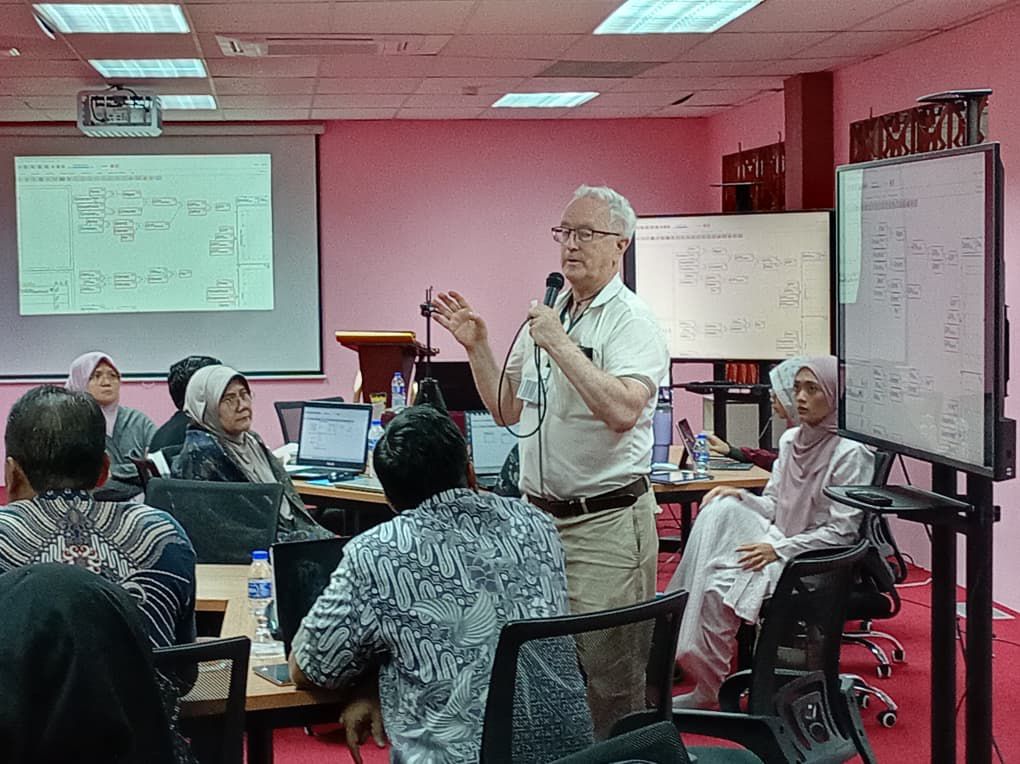

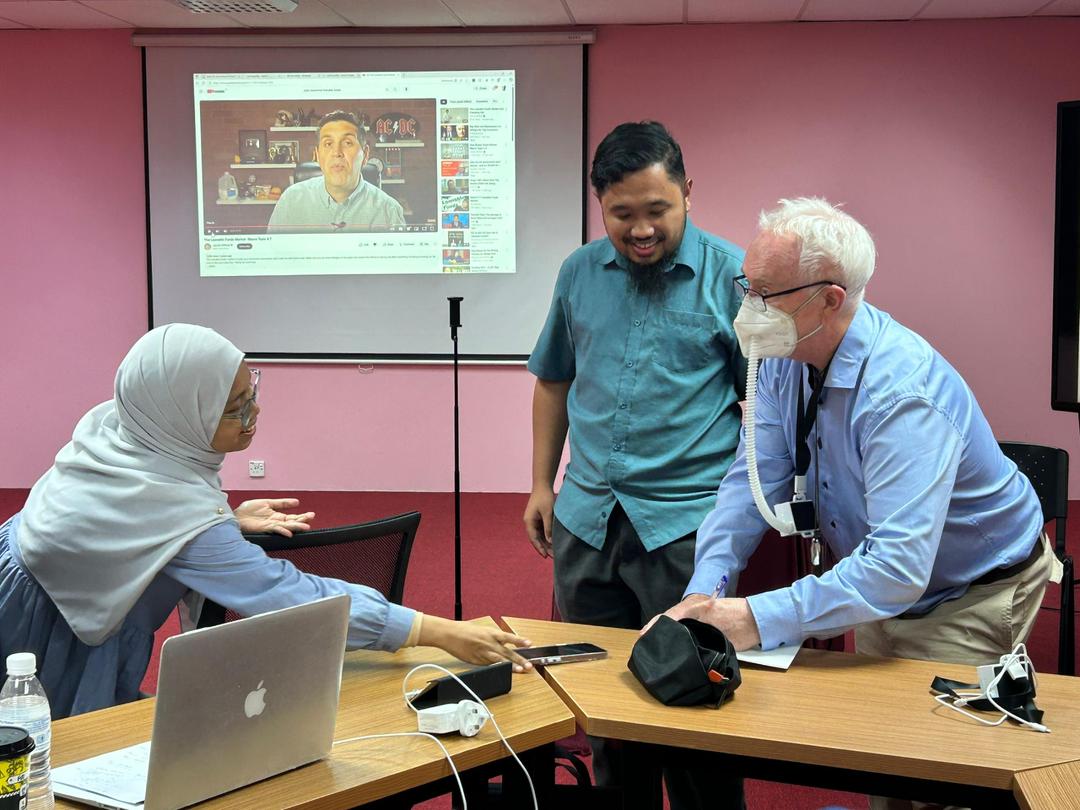

The three-day workshop A Critique of Neoclassical Economics with Prof. Dr. Steve Keen, held from 19 to 21 August 2025 at IIUM, provided participants with valuable insights into the limitations of mainstream economic theories and alternative approaches to economic analysis. Across six lectures, Prof. Keen explored topics such as economic fallacies, the role of money and financial institutions, critiques of supply-side models, inconsistencies in demand theory, and advanced modelling approaches including complexity, non-equilibrium dynamics, and debt-driven macroeconomic analysis. The program successfully enriched participants’ knowledge, encouraged critical thinking, and offered broader perspectives on economics beyond conventional frameworks.

This lecture highlighted how many mainstream economic assumptions are overly simplified and often fail to

capture real-world complexities. It encouraged a more critical approach towards “accepted truths” in economics

and the need to question whether models truly match reality.

This lecture highlighted how many mainstream economic assumptions are overly simplified and often fail to

capture real-world complexities. It encouraged a more critical approach towards “accepted truths” in economics

and the need to question whether models truly match reality.

This lecture revealed the weaknesses of supply-side models and the unrealistic assumption of perfect

competition. It showed that actual markets operate with imperfect competition and strategic behaviour, making

traditional models less reliable.

The discussion highlighted the limitations of traditional demand theory and utility-based models. Consumer

behaviour was shown to be far more complex than simple utility maximization, and alternative approaches were

presented as more effective in explaining real-world choices.

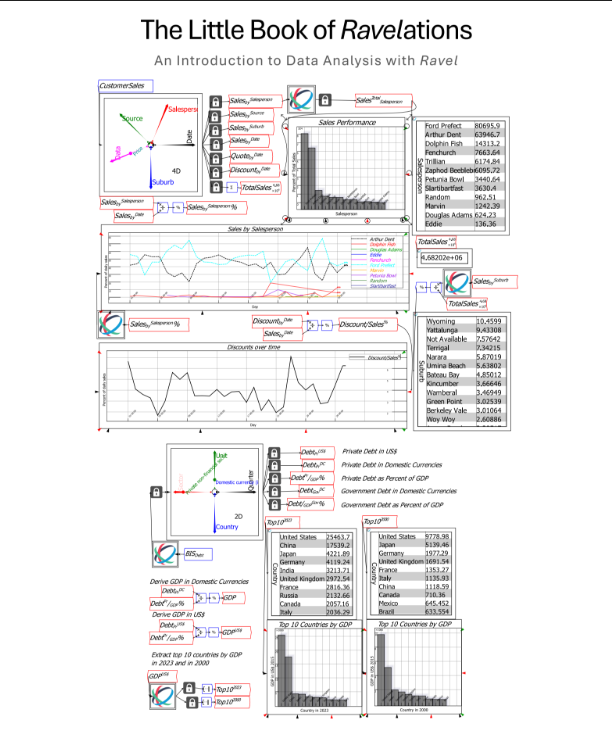

This session provided valuable insights into how economies function as complex, dynamic systems rather than

static models. Agent-based modelling was introduced as a more realistic method to simulate interactions

between different economic actors.

The final lecture emphasized the importance of debt and income flows in shaping macroeconomic outcomes. It

highlighted how instability, feedback loops, and dynamic disequilibrium play critical roles in understanding

economic crises beyond equilibrium-focused models.